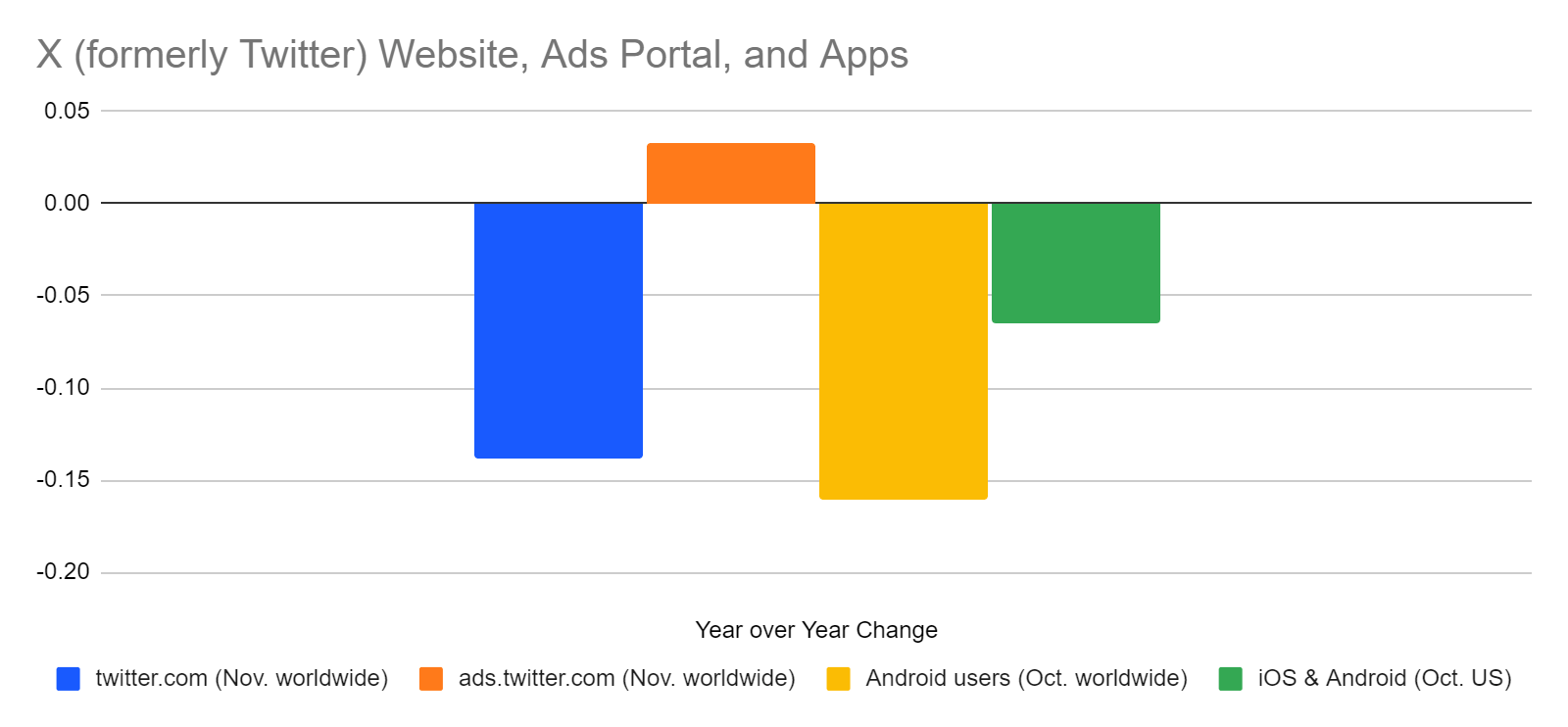

Despite all this, X is caught in a slow slide, bleeding out about 14% each year in the engagement game with users and advertisers, as reported by SimilarWeb. The risk? Advertisers might ditch X, potentially driving it to bankruptcy. Musk’s nonchalant attitude, confident users would point fingers at advertisers, adds spice to the mix.

But, hey, let’s peek at the numbers on twitter.com, X’s online playground. November’s early estimates hint at a 13.8% drop in visits (5.9 billion to be exact) compared to the same month last year. That’s a red flag. Now, talking ads, the portal at ads.twitter.com is doing a little cha-cha—it might edge up by 3.2% in November, or so the preliminary estimate suggests. But broaden the scope to the last 12 months, and whoops, a 14% nosedive compared to the previous year.

Stateside, the scene isn’t pretty. Monthly active users in the US dip by 6.5%, and globally, on Android, we’re talking a hefty 16% year-over-year plunge.

Numbers aside, the vibe online has been like a rollercoaster for X. It’s been a bumpy ride, with highs and lows, but lately, it’s more on the downslope.

And here’s the question hanging in the air: how long can X defy gravity? That magic number of around -14% keeps popping up, a consistent drumbeat of decline. The ad portal’s dance with a potential increase in November might be a blip, a quirk in the year-over-year dance, especially during Musk’s early days of uncertainty on the platform’s future.

Charts courtesy of Similarweb.

But, here’s the real issue—advertiser interest soaring while the audience shrinks? That’s a recipe for trouble. Even if the little guys stick around, the big spenders might not be feeling the love when Musk basically shows them the door. The tug-of-war between Musk’s bravado and the advertiser purse strings sets the stage for X’s uncertain future.