Welcome to the exciting journey of boosting your financial literacy with ChatGPT!

Now, where financial decisions can have long-lasting impacts, it’s more important than ever to be financially literate.

ChatGPT, a cutting-edge AI language model developed by OpenAI, emerges as a game-changer in this arena.

In this comprehensive guide, we’ll dive deep into how ChatGPT can be your partner in mastering the art of financial management.

So, let’s get into this journey to empower you with knowledge, tools, and techniques to enhance your financial literacy.

Understanding Financial Literacy

Financial literacy is having a set of skills and knowledge that allows you to make informed and effective decisions with your financial resources.

It’s not just about understanding basic financial terms; it encompasses a broader spectrum of understanding that helps individuals navigate the financial world confidently.

Here’s a closer look:

1. Key Components of Financial Literacy

- Budgeting: Understanding how to plan and manage your income and expenses.

- Saving: Knowing the importance of saving for future needs and emergencies.

- Investing: Being aware of different investment options and their risks and returns.

- Debt Management: Knowing how to manage debts effectively, including loans and credit cards.

- Insurance: Understanding the types of insurance and how they protect against financial risks.

- Retirement Planning: Planning for retirement, understanding pension plans, 401(k)s, IRAs, and other retirement tools.

2. Why is Financial Literacy Important?

- Empowers Individuals: Financial literacy empowers people to make informed financial decisions, avoid pitfalls, and understand the consequences of their actions.

- Promotes Financial Health: It leads to better financial health, like increased savings, reduced debt, and a better credit score.

- Reduces Financial Stress: Understanding finances can significantly reduce anxiety and stress related to money.

- Prepares for Life’s Changes: It prepares individuals for life events such as buying a home, saving for education, or retirement.

3. Challenges in Achieving Financial Literacy

- Complex Financial Products: The growing complexity of financial products makes it harder for the average person to understand.

- Lack of Education: Many people lack access to basic financial education.

- Evolving Financial Trends: Keeping up with the constantly evolving financial trends and regulations can be challenging.

4. Improving Financial Literacy

- Education and Resources: Utilizing educational resources, like books, courses, and online platforms, including AI tools like ChatGPT.

- Practical Experience: Gaining practical experience through budgeting, investing, and other financial activities.

- Seeking Professional Advice: Consulting financial advisors for more complex financial decisions.

5. The Role of Technology in Financial Literacy

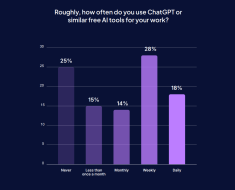

- Accessibility of Information: Technology, especially AI tools like ChatGPT, makes financial information more accessible.

- Interactive Learning: AI and online platforms offer interactive and personalized learning experiences.

- Real-Time Assistance: AI tools provide real-time help and feedback, making the learning process more efficient.

Financial literacy is a crucial skill in today’s world, impacting almost every aspect of life.

From managing daily expenses to planning for retirement, a solid foundation in financial literacy is key to achieving financial security and independence.

Tools like ChatGPT offer a unique opportunity to enhance this knowledge in an interactive, personalized, and accessible manner.

The Role of ChatGPT in Financial Education

1. Providing Accessible Financial Information

- Instant Responses: ChatGPT offers immediate answers to a wide range of financial queries, from basic concepts to complex strategies.

- Broad Knowledge Base: It draws from a vast pool of financial data, ensuring that the information it provides is comprehensive and diverse.

2. Personalized Financial Guidance

- Tailored Advice: ChatGPT can offer personalized financial advice based on the user’s unique financial situation and goals.

- Interactive Learning: It engages users in interactive conversations, making the learning process more engaging and effective.

3. Enhancing Financial Literacy

- Explaining Complex Concepts: ChatGPT simplifies complex financial terminologies and concepts, making them easier to understand for beginners.

- Scenario-Based Learning: It can simulate various financial scenarios, helping users to understand the potential outcomes of different financial decisions.

4. Budgeting and Expense Tracking

- Budget Creation: ChatGPT can assist in creating a budget by analyzing income and expenses and suggesting optimal budgeting strategies.

- Expense Analysis: It can help track and analyze spending patterns, providing insights for better financial management.

5. Investment and Wealth Management

- Investment Education: ChatGPT educates users about different types of investments, their risks, and potential returns.

- Portfolio Suggestions: While not a substitute for professional financial advice, it can offer general guidance on portfolio diversification and management.

6. Debt Management and Credit Education

- Debt Strategy Development: ChatGPT can suggest strategies for managing and paying off debts effectively.

- Credit Score Improvement Tips: It provides insights into how credit scores work and offers tips for improving them.

7. Real-Time Financial Updates and Insights

8. Access to Global Financial Perspectives

- International Finance: ChatGPT can offer insights into global financial markets, helping users understand international investment opportunities and risks.

9. Bridging the Financial Education Gap

- Accessible to All: It offers a free or low-cost way for individuals to access financial education, regardless of their background or income level.

- Language and Cultural Sensitivity: ChatGPT can interact in multiple languages, making financial education more accessible to non-English speakers.

10. Continuous Learning and Adaptation

ChatGPT’s role in financial education is multifaceted and profoundly impactful. It democratizes access to financial information, tailors learning experiences, and provides a platform for continuous financial learning and exploration.

Whether for budgeting, investing, debt management, or understanding complex financial concepts,

ChatGPT stands as a valuable resource for anyone looking to enhance their financial literacy and make more informed financial decisions.

Section 1: Personal Financial Management with ChatGPT

Budgeting and Expense Tracking

- ChatGPT-Assisted Budgeting: Learn how ChatGPT can help you create a budget tailored to your income and expenses. It can suggest budgeting methods, track expenses, and provide insights into your spending patterns.

- Expense Analysis: ChatGPT can analyze your spending habits and offer suggestions for cost-cutting, ensuring a more efficient allocation of resources.

Debt Management and Credit Score Improvement

- Navigating Debt with AI: Discover how ChatGPT can guide you in managing and paying off debts. It can provide strategies tailored to different types of debt, from credit cards to student loans.

- Credit Score Insights: ChatGPT can educate you on factors affecting your credit score and offer tips to improve it, which is crucial for financial health.

Section 2: Investing and Wealth Management with ChatGPT

Basics of Investing

- Investment Education: Grasp the basics of different investment vehicles like stocks, bonds, and mutual funds through interactive conversations with ChatGPT.

- Risk Assessment Tools: ChatGPT can help assess your risk tolerance and suggest investment strategies accordingly.

Retirement Planning

- Planning for the Future: Learn about retirement planning, including 401(k)s and IRAs, and how to make informed decisions for a secure future.

- Portfolio Management Guidance: ChatGPT can provide insights on portfolio diversification and rebalancing techniques to optimize your retirement savings.

Section 3: Utilizing ChatGPT for Advanced Financial Concepts

Understanding Taxation

- Tax-Related Queries: ChatGPT can clarify taxation concepts and assist in understanding various tax forms and deductions.

- Strategic Tax Planning: Discover strategies for tax efficiency in investments and income, guided by ChatGPT’s vast knowledge base.

Real Estate and Mortgage Advice

- Navigating the Housing Market: Gain insights into the real estate market, mortgage options, and the home buying process with ChatGPT’s assistance.

- Mortgage Calculations: Utilize ChatGPT to understand mortgage calculations, interest rates, and the impact of various loan terms on your finances.

Section 4: Personalizing Financial Learning with ChatGPT

Customized Learning Experiences

- Interactive Learning: ChatGPT offers a personalized learning experience, adapting to your knowledge level and financial goals.

- Scenario-Based Learning: Engage in simulated financial scenarios to apply your learning in real-life-like situations.

Staying Informed and Updated

- Market Trends and News: ChatGPT keeps you updated on the latest financial news and market trends, helping you make informed decisions.

- Continuous Learning: As financial markets evolve, ChatGPT continues to learn, providing you with up-to-date information and strategies.

Conclusion

ChatGPT is more than just an AI tool; it’s a companion in your financial literacy journey.

By leveraging its capabilities in budgeting, investing, advanced financial concepts, and personalized learning, you’re well on your way to becoming financially savvy.

Remember, financial literacy is not just about understanding money; it’s about making informed decisions that lead to financial freedom and security.

With ChatGPT by your side, you’re equipped to navigate the complex world of finance with confidence and ease.