The integration of Artificial Intelligence (AI) into professions like law, accounting, and investment management has been evolving over several decades, with significant acceleration in recent years. Here’s a brief overview of AI’s journey in these fields:

Legal Industry

The legal profession’s initial forays into AI included expert systems which were not specifically legal but demonstrated rule-based systems’ potential. However, legal-specific systems emerged in the 1980s’ and in 1990s’. The 2000s’ saw the development of more sophisticated legal research tools. LexisNexis and Westlaw, initially database search tools, began incorporating more AI elements to enhance search efficiency and legal analysis.

Accounting Industry

Early AI in accounting involved the use of rule-based expert systems. These systems, like the one developed by Arthur Andersen & Co. in the 1980s, were designed to mimic the decision-making process of human experts in areas such as audit judgment. The focus shifted towards data mining and analytics, with tools emerging to assist in financial forecasting and fraud detection. Software used for audit data analytics, started incorporating more AI elements to enhance their capabilities.

Investment Management

AI’s earliest impact in investment management was through algorithmic trading, which gained popularity in the 1980s’. These algorithms could execute trades at a speed and frequency beyond human capabilities, based on predefined criteria. The introduction of robo-advisors in the late 2000s’ was a significant milestone. These platforms used AI to provide automated, algorithm-driven financial planning services with little to no human supervision.

Across these professions, the journey of AI started with basic automation and rule-based systems and has evolved to incorporate sophisticated machine learning, natural language processing, and predictive analytics. This evolution reflects the growing capabilities of AI and its increasing importance in decision-making processes in professional services.

Now, Artificial Intelligence (AI) is bringing about a significant transformation in legal, accounting, and financial services. These sectors, traditionally reliant on human expertise, are now embracing AI’s potential to enhance efficiency, accuracy, and client service. In the past, AI reshaped these industries and Generative AI will continue to reshape these services and the way are delivered to wealthy families.

AI in the Legal Industry:

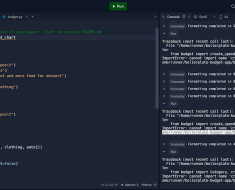

AI-driven tools have revolutionized the legal industry by automating tasks such as document analysis, legal research, and contract review. For wealthy families, this translates to more efficient handling of complex legal matters, estate planning, and trust management. AI tools can sift through extensive legal documents, predict case outcomes, and automate routine tasks, allowing lawyers to focus on strategy and client relations.

AI in the Accounting Industry:

In accounting, AI has automated mundane tasks like data entry, transaction categorization, and reconciliation. This automation is particularly beneficial for managing the intricate financial affairs of wealthy families. AI-driven predictive analysis and risk assessment tools provide insights for better financial planning and wealth management, ensuring accurate reporting and compliance with financial regulations.

AI in Financial Services:

The financial services industry has seen a significant impact from AI in areas like personal financial planning, wealth management, and algorithmic trading. Wealthy families benefit from AI-powered tools that provide personalized advice, optimize portfolio performance, and offer sophisticated investment strategies. Additionally, AI’s role in fraud detection and regulatory compliance adds a layer of security and trust in financial transactions.

Common Themes and Future Outlook:

Across these industries, the integration of AI highlights the need for a balance between AI-driven efficiency and human oversight. Ethical considerations, particularly in algorithm design and data training, are crucial to avoid biases. Data security remains a top priority, given the sensitivity of information handled in these sectors. This is particularly true when clients make decisions based on emotions rather than rational decisions, especially where ownership and control of family wealth and a family business are involved.

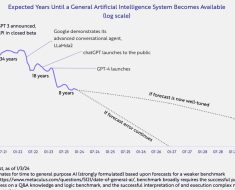

Future developments in AI might include more advanced machine learning algorithms, improvements in natural language processing, and integration with emerging technologies like blockchain to increase security. These advancements promise to further transform how services are delivered to wealthy families, necessitating continuous learning and adaptation from professionals.

Generative AI is redefining the professional services landscape, offering unparalleled efficiency and operational excellence in serving wealthy families These capabilities, though can disrupt what are relationship-based services. In order to avoid disruptions and missteps, the use of AI in these fields, requires a careful balance with human insight, ethical application, and stringent data security.