As technology continues to reshape traditional practices, financial institutions are confronted with the question: Is incorporating machine learning (ML) worth the potential challenges it brings? From enhanced predictive analytics to improved risk management, the promises of machine learning are enticing.

According to Havard University, ML can analyze historical data to understand the demand, supply, and inventory, then forecast the future’s demand, supply, and inventory. ML can forecast the client’s budgets and several other economic indicators, thus helping the business improve its performance.

This article will focus on the importance ML has on finance and how it has completely transformed the financial industry, ensuring efficiency and improved services.

A Review of Key Concepts

In the intricate sphere of financial affairs, where each choice holds weight and risks hide in every deal, a quiet revolution is happening — Machine Learning (ML). ML involves computers learning and getting better without specific instructions. Imagine this futuristic tech steering through the tricky worlds of banking, investing, and money decisions.

The financial world, once bound by old-fashioned ways, is changing like never before. ML isn’t just a far-off idea; it’s a lively power reshaping the industry. It’s not only about fancy algorithms; it’s a big change in how financial groups do things and plan.

Think of ML in finance, like adding a genius conductor to an orchestra. ML programs quickly analyze huge data sets, find patterns, guess trends, and make sense of the mess that financial markets usually are. ML is the unsung hero, silently working in the background, from spotting fraud to scoring credit.

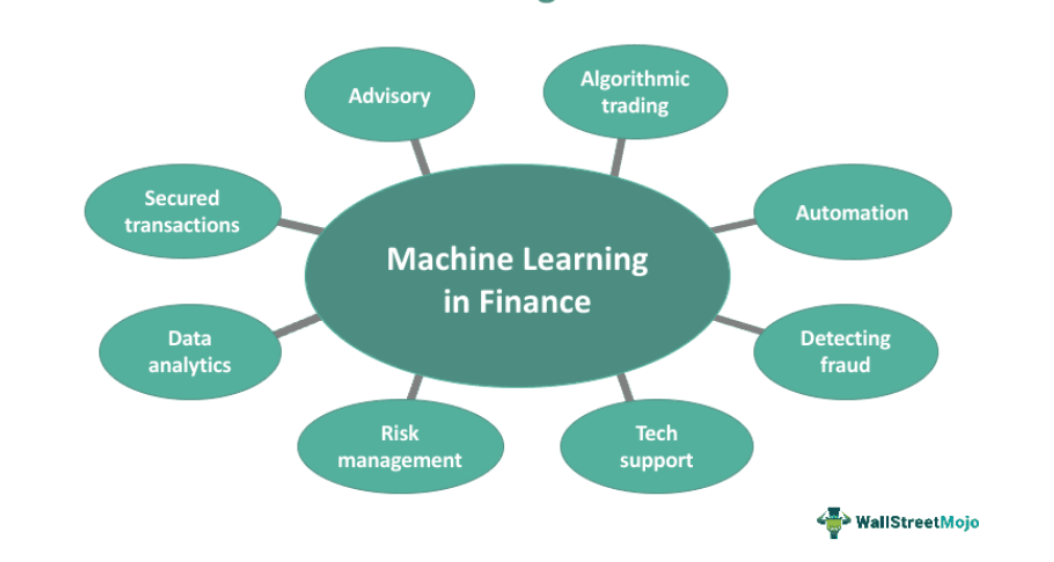

Applications of Machine Learning in Finance

Algorithmic Trading

Gone are the days of crystal balls; now, algorithms predict market movements with uncanny accuracy. Predictive modeling in algorithmic trading involves crunching historical data to forecast future trends. It’s akin to having a financial clairvoyant but powered by data.

Speed is the essence of high-frequency trading. ML algorithms process vast datasets at lightning speed, executing trades in milliseconds. It’s the Formula 1 of finance, where split-second decisions can make or break fortunes.

Credit Scoring and Risk Management

ML algorithms scrutinize creditworthiness with a precision that traditional models envy. By analyzing a borrower’s history and behavior, these algorithms calculate risk more accurately, empowering lenders to make informed decisions.

Unmasking financial chameleons, ML algorithms excel at fraud detection. They discern anomalies in transactions, spotting red flags that escape human eyes. It’s the digital Sherlock Holmes guarding the financial domain.

Customer Service

Say hello to your financial Siri. ML-powered chatbots and virtual assistants handle customer queries with finesse. They provide instant responses, freeing up human agents for more complex tasks. It’s customer service at the speed of thought.

Tailoring advice like a bespoke suit, ML analyzes customer data to offer personalized financial guidance. From investment strategies to budgeting tips, these algorithms play the role of a virtual financial advisor, understanding each customer’s unique needs.

Fraud Detection

Combatting financial fraud has never been more sophisticated. ML algorithms, armed with the ability to analyze vast amounts of transactional data in real time, detect anomalies and patterns indicative of fraudulent activities. This proactive approach saves financial institutions billions and also fortifies the trust between them and their clients. Statistics by DataCamp reveal that 56% of global executives said that artificial intelligence (AI) and machine learning have been implemented into financial crime compliance programs.

The Promise of Machine Learning in Finance

Incorporating ML in finance holds the key to unlocking many doors. This perfect partnership leads to an array of astounding advantages, propelling organizations to unparalleled efficiency and accuracy. Some of these benefits include:

Enhanced Decision-Making Processes

Machine Learning algorithms act as financial wizards, not wielding wands but leveraging data to enhance decision-making. These algorithms don’t just analyze; they learn, adapting to evolving market conditions. Imagine a decision-making process that not only considers historical data but evolves in real-time, making choices with the agility of a seasoned trader and the precision of a quant.

Improved Risk Management

Risk, the perennial companion of finance, meets its match. ML models dissect vast datasets to identify subtle patterns indicative of potential risks. This isn’t just about foreseeing market fluctuations; it’s about understanding the intricate dance of variables that could impact investments, enabling financial institutions to navigate stormy market seas with a clearer map.

Increased Efficiency and Automation

The clock ticks, and in the world of finance, every second counts. ML injects efficiency into financial operations with a dose of automation. Mundane tasks like data entry and processing become the domain of algorithms, freeing up human resources for more strategic thinking. Efficiency gains shouldn’t just be about speed; it should be about redirecting human effort towards creative problem-solving.

According to McKinsey, ML is an increasingly powerful tool to drive automation. Unlike basic, rule-based automation — which is typically used for standardized, predictable processes—ML can handle more complex processes and learn over time, leading to greater improvements in accuracy and efficiency.

Potential for Uncovering Hidden Patterns and Trends

Financial markets are like vast oceans, hiding treasures beneath their surface. Machine Learning acts as the explorer’s compass, uncovering hidden patterns and trends that elude traditional analysis. ML algorithms sift through data noise to reveal insights that can be the difference between following the trend and setting it.

Is the Juice Worth the Squeeze?

On one side of the scale, ML dazzles with its potential. It unlocks insights buried in data, revolutionizes risk management, and ushers in a new era of efficiency. The allure is powerful, but not without its counterpart – the weighty challenges. Data privacy concerns, regulatory hoops, and the enigma of algorithmic decisions cast shadows over the sunny promises.

Finance, as ever, demands a cold, hard look at the numbers. The Return on Investment (ROI) for ML in this realm can be a compelling narrative or a cautionary tale. Initial implementation costs, training algorithms, and adapting infrastructure can be significant hurdles. However, success stories paint a picture of improved accuracy in predictions, reduced fraud, and operational cost savings that might just tip the scales.

Peering into the crystal ball, we must ponder the enduring impact on finance. Will ML propel the industry into unprecedented heights of efficiency and profitability? Or will it introduce risks and dependencies that we’re yet to fully comprehend? The long-term implications echo through the corridors of financial institutions, prompting reflection on sustainability, adaptability, and the fundamental nature of financial decision-making.

Conclusion

Using machine learning in finance can really change how things are viewed. Even though it’s tricky and complicated, the good stuff it brings — like doing things more accurately, managing risks, and making calculated predictions — shows that dealing with the challenges of using machine learning is worth it. As tech keeps improving, bringing machine learning into finance makes things smoother and brings in new ideas. This sets up the industry to keep growing and staying strong in a world that’s always changing.