In the weeks ahead, Ethereum (ETH) looks poised for growth, fueled by the upcoming Dencun upgrade’s final testnet on February 7, heightened expectations for an Ethereum spot ETF, and favorable market dynamics following Bitcoin’s (BTC) stabilization.

In light of the above and Ethereum’s ongoing cost-cutting upgrades, Finbold sought assistance from CoinCodex to utilize its AI-powered machine-learning algorithms to evaluate the anticipated price of ETH by the month’s end.

These algorithms analyze dynamic market conditions and closely examine pertinent indicators to predict the probability of this cryptocurrency gaining value by the end of February.

According to the algorithms, the projected price for ETH is expected to decrease to $2,273 by February 29, marking a loss of -1.51% from the current level of $2,308 at the time of writing.

Analyst ETH predictions

While the AI predictions take into account technicals, multiple real-world factors might positively impact Ethereum’s price in the upcoming period, the most important being the Dencun upgrade, which will potentially reduce the transaction costs and increase transaction capacity on ETH network for layer-2 blockchains and address scalability.

Add a potential Ethereum ETF approval into the equation, and ETH looks poised to reach $3,500 – $4,000 in the next 3-6 months, according to cryptocurrency expert Michael van de Poppe.

van de Poppe suggests ETH, driven by factors like the upcoming Dencun upgrade’s final testnet on February 7, excitement over a potential Ethereum spot ETF, and a trend of capital rotation from Bitcoin to the broader cryptocurrency ecosystem post-halving will be behind the price climb.

Bearish ETH forecast

Nonetheless, caution is warranted as technical indicators, including ETH’s weekly candle, hint at bearish trends. Crypto analyst Poseidon noted on February 1 that the market had undergone a retracement, effectively filling the gap and reverting to the weekly opening levels.

The expert noted bulls must achieve more substantial weekly close figures to maintain the current upward trajectory. Should they fall short, Ethereum could face a downturn, potentially revisiting the $2,100 price level

Ethereum price analysis

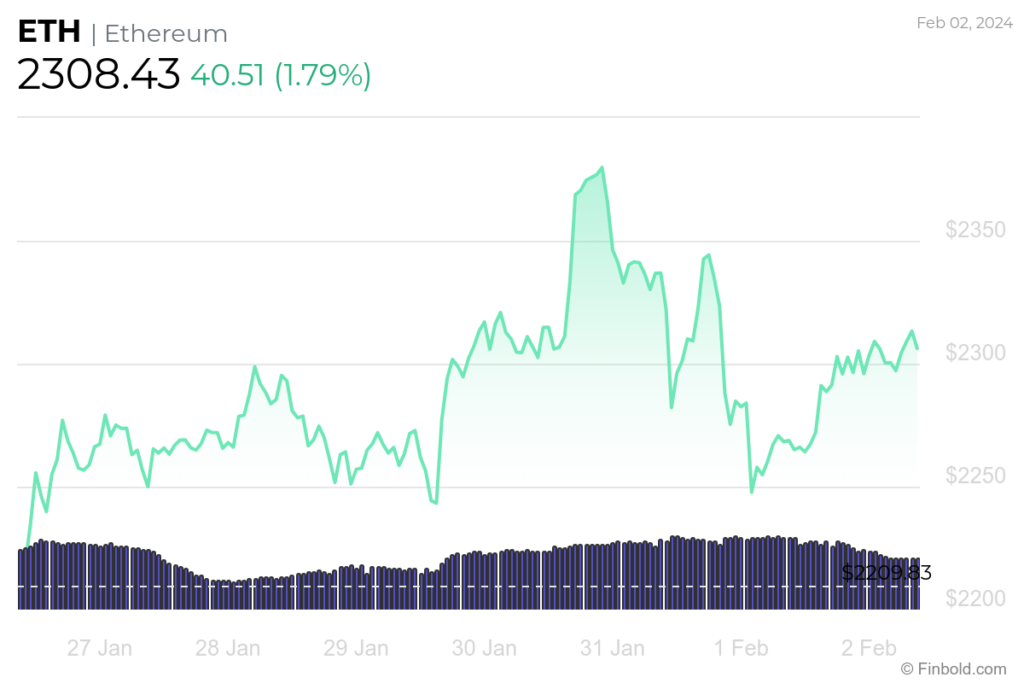

Meanwhile, at the time of press, ETH was trading at $2,308, showcasing an increase of 1.79% in the past 24 hours, with gains of 4.46% in the previous week. The nearest support level for ETH sits at $2,104, while the closest resistance level is $2,401.

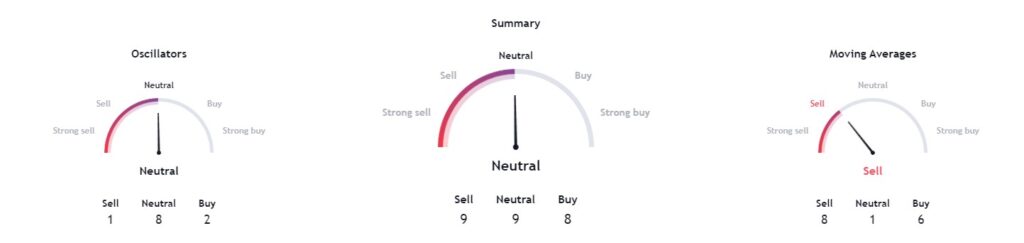

Technical indicators for Ethereum are set at ‘neutral’ with a rating of 9. Moving averages point to ‘sell’ at 8. Meanwhile, oscillators are set to ‘neutral’ at 8, thus remaining indecisive about future price movements.

Whether Ethereum’s price will move upward in the next month or is due for a retest might be hard to tell with the conflicting indicators.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.