Although Bitcoin (BTC) is struggling to retake the $43,000 price level, its crossing into the $40k region is important to begin with. However, machine learning and artificial intelligence (AI) algorithms are bearish, predicting it will lose this critical threshold by the end of next month.

Indeed, the price of Bitcoin could decline during February, dropping to $38,699 by February 29, 2024, at least according to the advanced algorithms deployed by the cryptocurrency and stock monitoring and prediction platform CoinCodex, as per the latest data retrieved by Finbold on February 1.

Specifically, if the above projections, calculated with the help of the historical Bitcoin price dataset and accounting for the cyclical nature of its halvings, are correct, it would mean that the price of the maiden crypto asset would decrease by 8.28% from where it stood at the time of publication.

Bitcoin price analysis

For now, the flagship decentralized finance (DeFi) asset is changing hands at the price of $42,192, down 1.35% in the last 24 hours, up 5.31% across the previous seven days while accumulating a loss of 7.92% on its monthly chart, as the most recent data suggests.

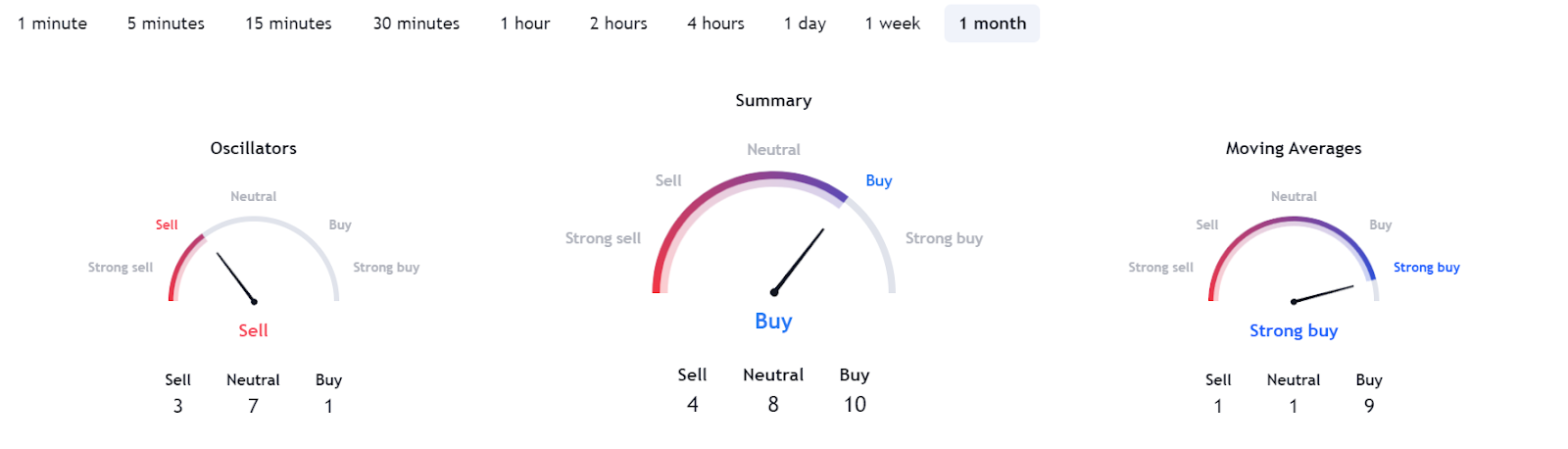

Elsewhere, the 30-day technical analysis (TA) gauges over at the finance and crypto market analytics website TradingView are bullish, suggesting a ‘buy’ at 10, from summarized oscillators pointing at a ‘sell’ at 3, and moving averages (MA) in the ‘strong buy’ zone at 9.

In conclusion, Bitcoin might, indeed, drop to the price range projected by the machine learning algorithms, but even if it does, it could prove an ideal opportunity to ‘buy the dip’ before the price growth resumes toward the halving, estimated to take place in late April 2024.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.