Within the field of artificial intelligence (AI), generative AI is rapidly transforming the healthcare sector. Generative AI models are able to create new data instances that bear a striking resemblance to real healthcare data by utilizing sophisticated machine learning methods. These cutting-edge methods have the power to completely change a number of healthcare-related fields, including medication development, patient care, and disease detection and diagnosis.

According to the Grand View Research report, the global generative AI in healthcare market size was estimated at $1.28 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 36.7% from 2023 to 2030. With its enormous potential to improve patient care and outcomes, generative AI is set to transform the healthcare industry completely. Generative AI can assist in providing hyper-personalized patient care, enable quicker and more affordable drug discovery, and increase the delivery of healthcare as a whole. It can do this by analyzing enormous data sets, improving medical imaging, simulating various medical settings, and predicting results.

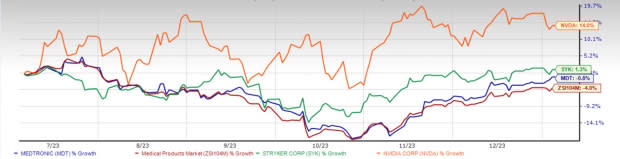

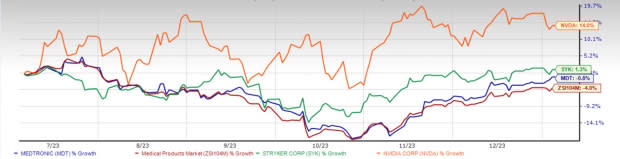

Accordingly, for investors who are mainly looking to tap the rising prospects in this lucrative AI market, it’s the ideal time to enter the market and gain maximum return out of it. Here are the three stocks- Medtronic Plc MDT, Stryker Corporation SYK and NVIDIA Corporation NVDA which we expect to show solid returns in the coming period, banking on their solid AI-induced growth process.

Image Source: Zacks Investment Research

Generative AI Poised to Transform Healthcare

Over the past few years, generative AI has drawn the interest of payers, biopharmas, providers, and investors due to its potential to improve the effectiveness, efficiency, and innovation of healthcare delivery. Generative AI is a new tool that can help unlock a portion of untapped improvement potential existing in the healthcare industry, even though businesses have been using AI technology for years.

The application of AI in healthcare has a significant financial impact in terms of both revenue generation and cost reduction. AI-powered chatbots, for example, might offer patients and members quick, tailored assistance, reducing costly ER visits and enhancing access to preventative care.

Within hospitals and physician groups, generative AI technology has the potential to affect everything from continuity of care to clinical operations and contracting to corporate functions. Generative AI is being used to enhance medical imaging in areas such as radiology and pathology. It can generate synthetic images that simulate different conditions, improve image quality, and aid in the analysis and interpretation of medical images. Lately, Hologic HOLX developed Genius AI Detection 2.0, a deep-learning-based software that detects potential cancers in breast tomosynthesis images.

Based on the function, the global generative AI in the healthcare market is segmented into AI-assisted robotic surgery, virtual nursing assistants, aid clinical judgment/diagnosis, workflow & administrative tasks and image analysis. Generative AI techniques are used to enhance the quality and resolution of medical images.

3 Medical Stocks in Focus

The AI-led healthcare revolution is already well underway, and most companies are using artificial intelligence in one way or another. Here, we will discuss three companies that are leveraging the power of big data, machine learning, and neural networks to transform their business.

Medtronic uses AI and machine learning to improve patient outcomes and reduce healthcare costs in a number of areas, including cardiac care, diabetes management, and spinal surgery. Medtronic’s digitization is transforming the competitive landscape in the spine and with Aible, the company is leading the way. It is currently the only solution with integrated AI-based surgical planning with unit adaptive spine intelligence.

In December 2023, Medtronic entered into a definitive agreement to expand its partnership with Cosmo Intelligent Medical Devices, a subsidiary of Cosmo Pharmaceuticals. This strategic collaboration advances the use of AI in endoscopic care and strengthens Medtronic’s leadership in AI-integrated healthcare solutions.

MDT’s earnings are expected to increase by 5.5% in the next five years. It currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Stryker uses AI and machine learning to improve patient outcomes and efficiency in a number of areas, including surgical planning, medical imaging, and patient monitoring. Stryker’s Blueprint platform combines AI with augmented reality to help surgeons visualize and plan procedures. Mako is Stryker’s robotic-arm-assisted surgery platform that can be used for total knee, hip and partial knee replacement procedures. The platform’s technology enables surgeons to do pre-operative planning as well as precise surgeries, thus helping them provide effective and personalized surgical experiences to patients. The platform is currently the leading player in the robotic-assisted surgery market, with its installations having touched record levels in most of the quarters in the past three years.

Stryker’s focus on the continued expansion of Mako in new patient populations will likely enable the robotic platform’s growth momentum to continue in the rest of 2023. Moreover, continued software upgrades like the Q Guidance platform and the addition of technologies to work along with the platform should boost adoption.

SYK’s earnings are expected to grow by 10.1% in the next five years. It currently carries a Zacks Rank of 3.

NVIDIA is gaining from the strong growth of artificial intelligence (AI), high-performance computing and accelerated computing. The data center end-market business is likely to benefit from the growing demand for generative AI and large language models using graphic processing units (GPUs) based on NVIDIA Hopper and Ampere architectures. A surge in hyperscale demand and a solid uptake of AI-based smart cockpit infotainment solutions are acting as tailwinds.

NVIDIA’s GPUs are rapidly benefiting from the proliferation of AI. By applying its GPUs in AI models, the company is expanding its base in other untapped markets like automotive, healthcare and manufacturing, which will support its earnings and revenues. The company recently collaborated with the top-ranked OEMs, including Dell, HP and Lenovo, to deliver powerful workstations, including Quadro RTX GPUs and its new CUDAX AI accelerated software. A steady ramp-up of new products is enabling the company to gain a competitive edge over the likes of AMD and Intel and also widen its market share.

NVDA’s earnings are expected to grow by 13.5% in the next five years. It currently carries a Zacks Rank of 2 (Buy).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Medtronic PLC (MDT) : Free Stock Analysis Report

Stryker Corporation (SYK) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Hologic, Inc. (HOLX) : Free Stock Analysis Report