Pixelimage

We previously covered Digital Realty Trust (NYSE:DLR) in September 2023, discussing its justified premium valuations and stock rally, attributed to the cloud computing demand post-COVID-19 reopening, Metaverse hype, and generative AI boom.

Combined with the excellent consensus forward estimates and expanded forward dividend yields, we had rated the stock as a Buy then, particularly for investors who were looking for an alternative way to partake in the generative AI party.

In this article, we shall discuss why we maintain our Buy rating for the DLR stock, thanks to its improved monetization rate, healthier balance sheet, and impressive generative AI tailwinds through 2027.

Combined with its recently announced Data Center partnership with Realty Income (O)/ Blackstone (BX) and improving EBITDA to debt ratio, we believe that DLR remains well capitalized to grow profitably moving forward.

The Generative AI Investment Thesis Has Been Upgraded Indeed

For now, DLR has reported a top-line beat in its FQ3’23 earnings call, with rental revenues of $1.39B (+3.2% QoQ/ +17.7% YoY) and core FFO per share of $1.62 (-3.5% QoQ/ -2.9% YoY).

With the most advanced AI chips limited for sales in certain countries, it is apparent that US-based Data Center players, such as DLR, will benefit from the increased domestic availability, consequently allowing the REIT to accelerate its expansion.

With the US boasting the highest number of data centers globally at 5.37K as of September 2023, it is unsurprising that the REIT operates over 100 centers in the Americas, comprising over 30% of its existing portfolio.

As of FQ3’23, DLR also reports growing new leases in the Americas at 49.1 MW (+457.9% QoQ/ -37.6% YoY), with the region commanding the highest Average Base Rent [ABR] at an average of $240 per square feet (+120.1% YoY).

This number well exceeds the EMEA ABR of $202 per square feet (+16.7% YoY) and APAC ABR of $192 per square feet (+12.9% YoY), naturally contributing to the expansion in the overall ABR to $223 per square feet (+88.9% YoY).

These numbers demonstrate why the REIT’s prospects remains excellent ahead, with its operations in the US likely to continue being its top and bottom line driver.

Furthermore, the DLR management has reiterated its FY2023 revenue guidance of $5.5B (+17.2% YoY), adj EBITDA to $2.7B (+9.3% YoY), and FFO per share of $6.60 at the midpoint (-1.4% YoY).

While there is a reduction in its FQ4’23 portfolio occupancy rate to 83.5% at the midpoint, compared to the previous 84.5%, readers need not be concerned, since it reflects “the delayed timing of the sale of a vacant non-data center asset.”

It is apparent that demand continues to outstrip supply, with DLR already reporting an accelerating same capital cash Net Operating Income growth of +9.4% in FQ3’23, building upon the excellent growth of +5.6% in FQ2’23 and +5% in FQ3’22.

The same is demonstrated by the REIT’s time lag between signings and commencements for up to twelve months in FQ3’23, compared to eleven months in FQ2’23 and seventeen months in FQ3’22.

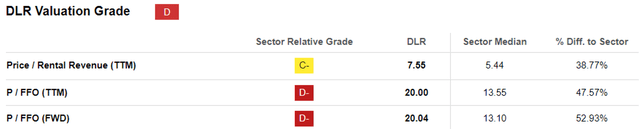

DLR Valuations

Perhaps this is why DLR’s FWD Price/ FFO valuations of 20.04x has been somewhat inflated, with it consistently rising from our previous article of 19.03x and 3Y pre-pandemic mean of 17.58x.

Then again, when compared to its Data Center REIT peers, such as Equinix (EQIX) at 35.84x, Iron Mountain (IRM) at 22.61x, and American Tower (AMT) at 20.43x, it appears that DLR’s valuation is still reasonable enough.

This is especially since multiple generative AI players, such as Nvidia (NVDA) and Advanced Micro Devices (AMD) have guided even more promising numbers ahead.

For example, NVDA has reported an impressive Data Center revenues of $14.51B (+40.6% QoQ/ +278.8% YoY) in FQ3’24 (Q3’23) while offering another promising FQ4’24 (Q4’23) revenue guidance of $20B (+10.3% QoQ/ +230.5% YoY) and GAAP gross margin guidance of 74.5% (+0.5 points QoQ/ +11.2 YoY).

The insatiable demand for NVDA’s offerings is highly evident indeed, attributed to the robust pricing power, compared to FY2020 (CY2019) gross margins of 62% (+0.8 points YoY).

The same has been highlighted by AMD, attributed to the raised projected AI Accelerator TAM from the previous estimate of $150B by 2028 to $400B by 2027, effectively accelerating the rate of AI chips market growth from a CAGR of +37.97% to an upsized CAGR of +91.09%.

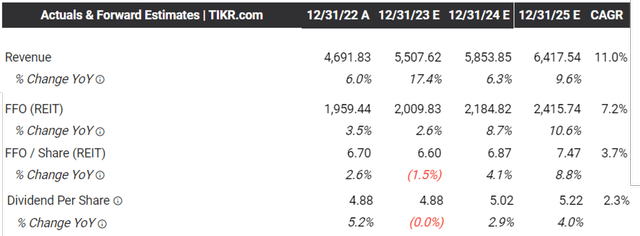

The Consensus Forward Estimates

The same profitable growth has been projected by the consensus, with DLR expected to generate an impressive top and bottom line CAGR of +11% and +3.7% through FY2025, respectively. This builds upon its historical growth trend of +14% and +2.7% between FY2016 and FY2022.

Inherent to REITs in general, we believe that the management has also executed well, attributed to the well balanced dilutive equity raises and debt reliance.

As of the latest quarter, DLR reported 311.34M of shares outstanding (+4.52M QoQ/ +14.92M YoY) and $15.82B of long-term debts (-6.7% QoQ/ +2.3% YoY).

While its TTM FFO Payout Ratio of 73.83% may appear to be elevated compared to the sector median of 62.40%, we are not overly concerned, since the REIT remains profitable as discussed above.

Furthermore, the management has made the prudent choice to engage on multiple partnerships for its Data Center expansions, minimizing its near-term liquidity risks at a time of uncertainties.

Nonetheless, with interest rates likely to moderate from these peak levels, we may see DLR’s elevated annualized FQ3’23 interest expenses of $443.08M (inline QoQ/ +44.7% YoY) and weighted average interest rates of 2.89% (+0.03 points QoQ/ +0.56 YoY) moderate from henceforth.

In any case, the REIT’s EBITDA to debt ratio has been consistently declining to 6.3x as well, down from 6.8x in FQ2’23 and 6.7x in FQ3’22, implying its improved credit rating and ability to service its debt obligations.

As a result, we maintain our confidence that DLR will continue to execute brilliantly, further aided by the lifting sentiments with the “Fed signaling a pivot by 2024,” likely to trigger the recovery of the macroeconomic outlook ahead.

So, Is DLR Stock A Buy, Sell, or Hold?

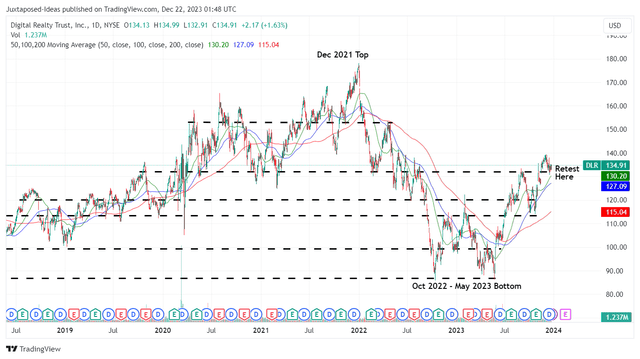

DLR 5Y Stock Price

For now, DLR has failed to sustain its upward momentum while appearing to retest the previous resistance levels of $130s. However, readers need not fret, since this phenomenon is likely attributed to the correction in its stock prices after the ex-dividend date of December 14, 2023.

Based on the management’s FY2023 FFO per share guidance of $6.60 and its FWD Price/ FFO valuation of 20.04x, it appears that the stock is trading near its fair value of $132.20.

Based on the consensus FY2025 FFO per share estimate of $7.47, there is also a more than decent upside potential of +13.2% to our long-term price target of $149.60.

This is on top of the slight expansion in its FWD dividend yields of 3.69%, compared to its 4Y average of 3.59% and sector median of 4.65%.

As a result of its dual pronged returns through moderate capital appreciation and dividend income, we maintain our Buy rating for the DLR stock. Investors may continue to add according to their dollar cost average.